2021-05-11 更正!甚至需要更少盎司的黃金和白銀才能買房

Correction! It Takes Even FEWER Ounces of Gold and Silver to Buy a House更正!甚至需要更少盎司的黃金和白銀才能買房

By Jeff Clark, Senior Analyst

We update our charts every year on how many ounces of gold and silver it takes to buy a house in the US. It’s an exciting thought, to potentially be in a position to buy a home with just your stash of bullion, a possibility that seems increasingly likely given the bloated nature of the housing market vs. low gold and silver prices.

我們每年都會更新圖表,以了解在美國購買房屋需要多少盎司的黃金和白銀。令人振奮的想法是,有可能僅憑您的金條購買房屋,鑑於房地產市場的漲潮與低位的黃金和白銀價格,這種可能性似乎越來越大

However, after reviewing the latest update, my colleague Mike Maloney thought it looked off—and after some digging we discovered what it was.

但是,在查看了最新更新之後,我的同事Mike Maloney認為它看起來不錯–經過一番挖掘,我們發現了它的真實含義。

It’s not an error, but in past charts we used the “average” US home price, and Mike wanted to look at the “median” home price instead.

這不是錯誤,但是在過去的圖表中,我們使用“平均”美國房屋價格,而Mike則希望查看“中位數”房屋價格。

Why median instead of average? Here’s a simple example…

為什麼是中位數而不是平均值?這是一個簡單的例子...

Let’s say 10 homes were recently sold, and nine sold for $100,000 but one sold for $1 million. The “average” price of the 10 homes is $190,000—but clearly most of the homes were priced less than this.

假設最近賣出了10所房屋,其中有9處以100,000美元的價格出售,但有一套以100萬美元的價格出售。 10所房屋的“平均”價格為190,000美元,但顯然大多數房屋的價格都低於此價格。

Median, on the other hand, is simply the price at which half the numbers are above it and half the numbers below it. Median is the “middle” of all the values. Average and median can be similar of course, but if there are more values at one end, or a few extreme values, that can make the “average” value misleading.

另一方面,中位數只是價格的一半,一半以上的數字,一半以下的數字。中位數是所有值的“中間”。平均值和中位數當然可以相似,但是,如果一端有更多值或幾個極端值,則可能會使“平均值”值產生誤導。

And that’s exactly what we have with home prices. Because some homes are exceedingly expensive, it pushes the average price higher. But the median price, the middle value, is more accurate, especially for the middle class.

而這正是我們擁有的房價。由於某些房屋非常昂貴,因此推高了平均價格。但是中間價格,即中間價,更為準確,特別是對於中產階級。

And that little change makes a fairly big difference…

一點點的變化就會帶來很大的不同……

Gold and Silver Ratios to Median Home Prices

黃金和白銀比率與房價中位數

Our recent article showed that it took 85.1 ounces of gold to buy the average priced home in the US at the peak of the gold market in January 1980.

我們最近的文章顯示,在1980年1月黃金市場的頂峰時期,要花85.1盎司的黃金才能在美國購買平均價格的房屋。

But based on median home values, it actually only took 74.9 ounces.

但是根據房屋中值,實際上只花了74.9盎司。

(X軸: 年份 ,Y軸: 黃金與中位數房價比例)

That may not seem like a big difference, but consider that at current gold prices it represents an investment today of over $18,000! That’s how much less you have to spend now if the ratio returned to its 1980 low.

這看似相差不大,但請考慮到,按照當前的黃金價格,這意味著今天的投資已超過18,000美元!如果該比率回到1980年的低點,那現在您需要花費的錢少了。

All the values are lower using the median price; it took 231 ounces to buy an average priced home last month, but only takes 197.1 for a median-priced home.

使用中位數價格,所有值均較低;上個月花了231盎司購買了中等價位的房屋,而中等價位的房屋只花了197.1盎司。

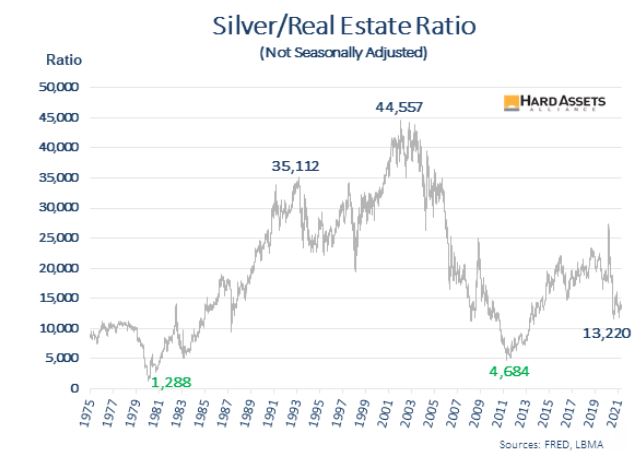

As usual, the difference with silver is more significant. It took 1,464 ounces to buy the average priced home in the US in January 1980, but to buy a median priced home it only took 1,288 ounces.

像往常一樣,與銀的區別更為明顯。 1980年1月,在美國購買平均價格的房屋花了1,464盎司,但在購買中等價格的房屋中,它只花了1,288盎司。

(X軸: 年份 ,Y軸: 白銀與中位數房價比例)

If the ratio returns to its 1980 low, you can invest $4,720 less in silver today.

如果該比率回到1980年的低點,您今天可以在白銀上少投資4,720美元。

As with gold all the values are lower using the median price. It took 16,056 ounces last month to buy an averaged priced home, but just 13,220 for a median home, a difference of 2,836 ounces, almost 6 mint cases.

與黃金一樣,使用中位數價格,所有價格均較低。上個月花了1,056盎司購買了一套中等價位的房屋,但購買一套中等價位的房屋只花了13,220盎司,相差2836盎司,幾乎是6箱鑄幣廠盒 (意旨: 500枚裝的一盎司銀幣的鑄幣廠怪獸盒)。

In other words, buying a home with gold and silver may indeed be more affordable than we reported. If you think you might someday want to swap some or all of your bullion for a house, it could take even fewer ounces than we thought.

換句話說,購買黃金和白銀的房屋確實比我們報告的價格更實惠。如果您認為有朝一日想將部分或全部金銀換成房子,那可能比我們想像的要少得多。

The difference here may be immaterial to some of you. But we wanted to pass it along because if we’re right about the direction, a home could be even more affordable than we realized, especially when it comes to silver.

對於某些人來說,這裡的差異可能並不重要。但是,我們希望將其傳遞下去,因為如果方向正確,那麼房屋的價格可能會比我們想像的要便宜,尤其是在白銀方面。

In fact, if a significant monetary event occurs, it’s possible we could see that ratio fall to just 1,000 ounces of silver.

實際上,如果發生重大的貨幣事件,我們有可能看到該比率下降到僅1,000盎司白銀。

Imagine being able to buy a house outright with just two mint cases of silver Eagles or Maples Leafs. Or if you own a lot more silver, an entire city block of real estate… or a beachfront paradise… or a working farm.

想像一下,僅用兩個鑄幣廠盒的美國鷹揚銀幣或加拿大楓葉銀幣就能直接購買房屋。或者,如果您擁有更多的白銀,整個房地產街區……或海濱天堂……或正在運轉的農場。

I don’t know about you, but I think I’ll buy some more silver!

我不知道你有什麼想法,但我想我會再買一些白銀!

Regards,

Jeff Clark

Shiny黃金白銀交易所

引用來源: HardAssetsAlliance.com

* 以上僅此作者個人觀點,不應做為投資建議。請務必詢問專業資產顧問再投資

**數據來源僅引用美國房價數據,不適用台灣市場。僅供參考!